Mark Zandi, chief economist at Moody’s Analytics, argues that government loans and subsidies are not particularly cost-effective for taxpayers because “universities and colleges just raise their tuition. It doesn’t improve affordability and it doesn’t make it easier to go to college.”

The federal student loan program seemed like a great idea back in 1965: Borrow to go to college now, pay it back later when you have a job.

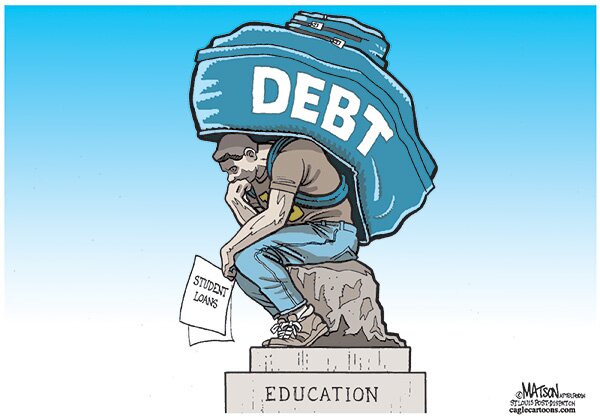

But many borrowers these days are close to flunking out, tripped up by painful real-life lessons in math and economics.

Surging above $1 trillion, U.S. student loan debt has surpassed credit card and auto-loan debt. This debt explosion jeopardizes the fragile recovery, increases the burden on taxpayers and possibly sets the stage for a new economic crisis.

With a still-wobbly jobs market, these loans are increasingly hard to pay off. Unable to find work, many students have returned to school, further driving up their indebtedness.

Average student loan debt recently topped $25,000, up 25 percent in 10 years. And the mushrooming debt has direct implications for taxpayers, since 8 in 10 of these loans are government-issued or guaranteed.

President Barack Obama has offered a raft of proposals aimed at fine-tuning the system and making repayments easier. Yet the predicament of debt-burdened former students has failed to generate much notice in the GOP presidential campaign. Instead, the candidates are dismissive of government student loan programs in general and Obama’s proposals in particular.

[…]